According to the latest edition of the International Energy Agency’s (IEA) Global Electric Vehicles Outlook, over one million electric cars were sold around the world in 2017. The cumulative number of electric and plug-in hybrid cars is estimated to be around 3 million, with China being the largest Electric Vehicle (EV) market in the world. China accounts for half the volume with 580,000 electric vehicles sold in 2017, clocking a 72 percent year-on-year increase.

Several factors are driving the growth of EVs in China, such as supportive government policies, stringent emission regulations, low/zero emission vehicle mandates and tighter fuel-economy standards. The Chinese government is encouraging its citizens to shift from the internal combustion to electric engines by enforcing policies and offering subsidies to generate demand for electric vehicles. As a response to these moves, around 500 EV companies have been established in China since 2013.

At present, five of the top ten EV companies are Chinese. We present here a competitive landscape of the Chinese EV market with an analysis of the six leading Chinese automobile players – BYD, BAIC, SAIC Motor, Geely and Chery. We take a closer look at their overall patent portfolios as well as those assets that directly address electric vehicles (EV) and related technologies such as hybrid vehicles, electric bikes and batteries.

Chinese EV Market – General Trends

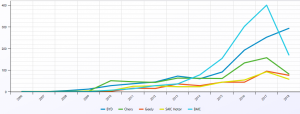

BYD and BAIC possess the largest patent portfolios among the Chinese EV companies. They also own the largest number of patent publications for the EV technologies.

As seen in Figure 1, BYD’s overall portfolio as well as its EV-specific filings show a consistent upward publication trend compared to the other competing companies listed above.

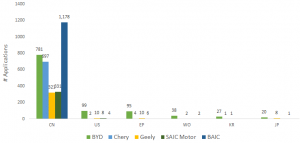

China is the preferred jurisdiction for the Chinese EV companies, with more than a 95% cumulative share of all the published applications filed by them. However, BYD shows a slight departure from this trend. Figure 2 shows us that BYD has a higher number of patent publications in the US and EP jurisdictions, than the other competing companies studied in this report.

Technology Landscape of the Top Chinese EV Companies

BYD produces the E6, a hatchback EV with a two-hour fast charge option. Another BYD model, the Song, is more popular among Chinese consumers as it’s one of the few compact crossover hybrids available.

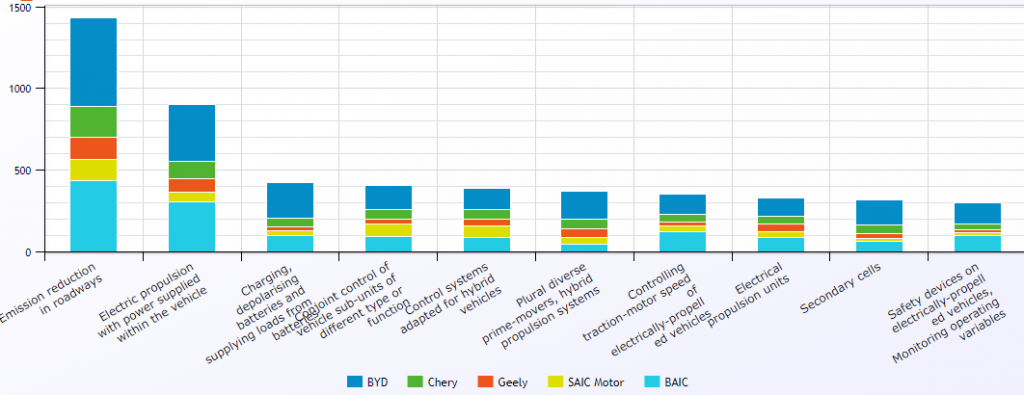

BYD started as a battery manufacturer and thus owns a significantly larger number of patent assets addressing battery-related technologies, compared to the other Chinese EV companies.

Chery produces a cost-effective electric mini-car called eQ that is one of the most affordable EVs on the market. Geely owns a company called Zhi Dou that produces the D2, an ultra-compact electric two seater. SAIC is one of the oldest Chinese car manufacturers and has joint ventures in place with Volkswagen (VW) and General Motors (GM). It produces and sells vehicles under the VW and GM brand names. BAIC acquired a leading Chinese EV manufacturer called BJEV in 2017. BAIC produces a large range of EVs, including mid-sized sedans, SUVs, and luxurious sedans.

Figure 3 shows the distribution of the top EV technologies across BYD, Chery, Geely, SAIC and BAIC.

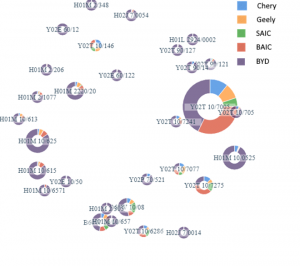

Figure 4 displays a Topic Map showing the comparison of the CPC codes addressed by the portfolios of Chery, Geely, SAIC, BAIC and BYD. The size of each bubble represents the total number of patent applications across portfolios for the specific CPC code, and the coloured sectors represent the relative number of applications in the respective portfolios of each patent holder. The bubble proximity refers to the “relatedness” of the individual CPC Codes.

A category-wise competitor comparison shows that BYD leads in most of the technology categories followed by BAIC.

BYD’s patent assets in the different categories, are comparable to those of the global EV companies.

Read our report to get the complete picture.

The Road Ahead

With the expansion of the Chinese EV market, it seems clear that the EV segment of the automotive market will not be driven only by the large incumbent European and Japanese players. The traditional auto manufacturers in China are shifting their focus to electric vehicles, and are being joined by other new tech companies that are emerging on the stage. These companies are working towards meeting the growing demand for EVs in China and have become the main drivers of the EV market. It will be interesting to track the growth of these companies, not just in China, but also as they perhaps expand their markets worldwide.